Property Taxes

Granger-Hunter Improvement District (District) relies on property tax revenues as part of our overall income to provide essential public services that all community members benefit from. These services include fire suppression from the District’s fire hydrants, ground water management, public health monitoring through routine contaminate testing of GHID’s water supply, water and wastewater infrastructure that was built by borrowing money and undeveloped/underdeveloped properties that are not being billed monthly but have connections that are readily available at those properties. Each of these services are not included in the monthly charges that are billed to our customers each month but are funded through property taxes.

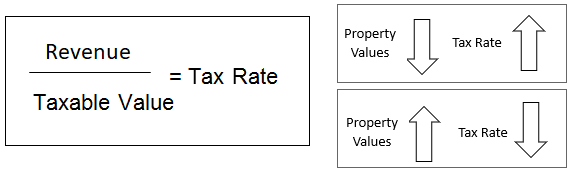

Utah state law regulates how much property tax revenue an entity can collect from property owners in its service area through the Property Tax Act (Utah Code 59-2). Each year the District is given a set amount of revenue from the county that does not change year over year. The rates that the property owner is assessed is a function of the value of the property. Each property valuation in the service area is aggregated together, and the rate is adjusted up or down based on those values so that the District receives the same amount of revenue each year regardless if property values increase or decrease. Simply put, as property values in the District as a whole go up, the rate goes down and vice versa.

Should the need arise to increase the amount of property tax revenue received from property owners each year, the District must pursue the “Truth-in-Taxation” process (Utah Code 59-2-919). The "Truth in Taxation" law requires public notices and public hearings when a taxing entity proposes an increase in its property tax revenues. The public hearings are required to allow officials to explain the reasons for the proposed increase and allow citizens to comment on any proposed increase. The highest rate that the District can levy is 0.0008 (Utah Code 17B-1-1002). Below is a schedule of the past ten years of property tax revenue in relation to property tax rates. The most recent Truth-in-Taxation process was done in 2021 effective for 2022 property tax assessments.

| Year Ended 12/31/ | Assessed Valuation (Adjusted) | District Tax Rate | Total Tax Revenues |

|---|---|---|---|

| 2013 | 4,519,973,198 | 0.000739 | 3,783,374 |

| 2014 | 4,825,171,728 | 0.000692 | 3,703,430 |

| 2015 | 5,088,830,768 | 0.000658 | 3,987,816 |

| 2016 | 5,622,001,855 | 0.000606 | 4,025,887 |

| 2017 | 6,107,452,986 | 0.000562 | 4,034,885 |

| 2018 | 6,861,271,676 | 0.000519 | 4,067,013 |

| 2019 | 7,412,919,588 | 0.000485 | 4,186,205 |

| 2020 | 8,219,695,556 | 0.000450 | 4,167,599 |

| 2021 | 9,104,272,947 | 0.000414 | 4,182,877 |

| 2022 | 10,935,743,006 | 0.000503 | 6,147,888 |

If you have any questions or would like to discuss this further, please contact our Controller at 801‑968‑3551.